🏡 HELOCs: A Love-Hate Relationship 🏡

In 2021, as construction costs soared, we were in the middle of remodeling our home. A HELOC was the lifeline we needed to complete the project without indefinitely living in a demo’d house. ![]()

![]()

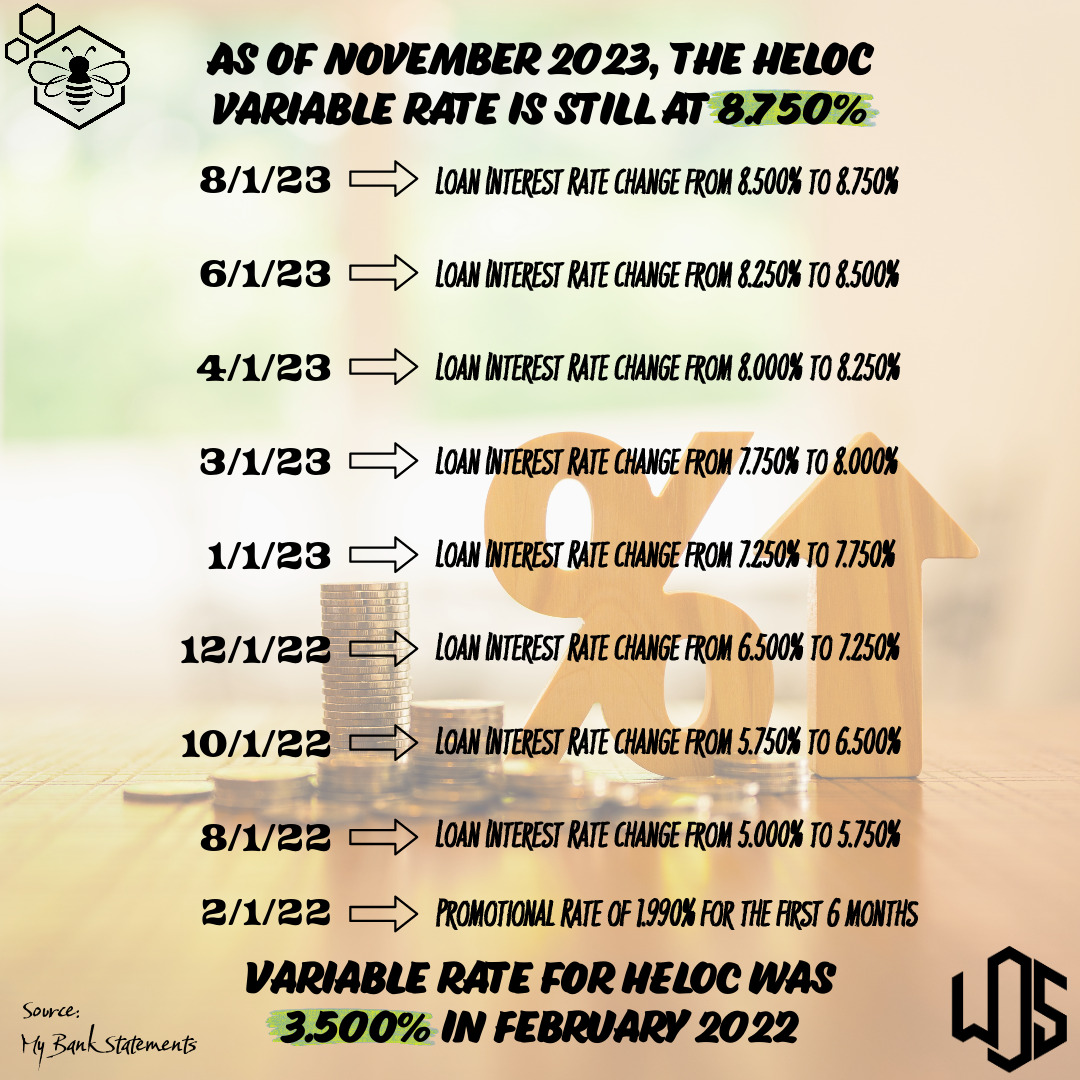

However, reality hit hard. Our monthly payment more than quadrupled in just one year, from June 2022 to June 2023, all while the balance remained the same. We knew the payment would increase as the initial rate was promotional (1.99%) when the variable rate at the time was 3.5%. But we definitely weren’t expecting our variable rate to be 8.75% today. ![]()

![]()

The sticker shock is real! ![]()

![]()

Being financially responsible sometimes brings unforeseen challenges. We opted for a HELOC to pull out only what we needed for the remodel, but looking back, a Home Equity Loan with a fixed rate, borrowing slightly more than necessary for the remodel (the art of budgeting for home projects is a conversation in itself), may have been the wiser choice. ![]()

![]()

![]()

Ever wondered why HELOCs aren’t as popular nowadays? ![]() Check out the graphic showcasing how fluctuating variable rates played out in my monthly bank statements.

Check out the graphic showcasing how fluctuating variable rates played out in my monthly bank statements. ![]()

Don’t hesitate to ask me any questions you may have about real estate. I’m here for all of them! ![]()

![]()

![]()

#HELOC #HomeEquity #FinancialGoals #HomeSweetHome #Remodeling #HomeRenovation #UtahRealEstate #Holladay